All projects

G2P choice for women: Lessons from SA, Zambia, Bangladesh

The Consultative Group to Assist the Poor (CGAP) commissioned Genesis to conduct a qualitative assessment with the aim of gathering empirical evidence to support the potential benefits of incorporating a choice-based model into the G2P (government to persons) payment system.

Future growth scenarios for Africa

How will Africa fare in the next 10 years and beyond? To tackle this question, Genesis was commissioned to write a research paper on what future growth scenarios could look like for the continent over the next decade. The work was background research for the African Development Bank’s strategy for 2023 to 2032.

Instant payments prompt review of interchange fees

Genesis Analytics was commissioned by a leading payment processor to write a concept paper that presented the consensus of the payments industry around the role and pricing of card payments in light of the introduction of emerging payment types such as instant payments.

MSME training needs assessed as cross-border payments go digital

Genesis was commissioned to undertake a training needs assessment for MSMEs engaged in digital cross-border trade. The study spanned five COMESA member states (Kenya, Malawi, Rwanda, Uganda and Zambia) and was aimed at boosting the use of digital financial services for cross-border payments in the region.

Encouraging the acceptance of QR codes by SA micro merchants

Genesis was commissioned by a global financial services company to conduct research on how to encourage the uptake of QR payments by micro merchants in South Africa, on behalf of a payment solutions provider aiming to enter this space.

Tapping into the MSME finance opportunity in Uganda

In a bid to understand the factors that constrain MSME finance in Uganda, the IFC commissioned Genesis to do a study of the general MSME landscape in the country, encompassing an analysis of the demand and supply-side of the MSME finance market.

Evaluating the impact of a central bank digital currency

Central banks across the world are rethinking approaches to financial and payments system infrastructure. New technologies such as distributed ledgers are revolutionising the way customers, businesses and financial intermediaries interact.

Addressing food security in a global pandemic

Genesis Analytics, through the support of the Bill and Melinda Gates Foundation (BMGF), advised the Solidarity Fund on if, and how, it could support a sustainable food production intervention that addressed the persistent experience of hunger by the most vulnerable households in South Africa (which has been aggravated by Covid-19).

Insights drive uptake of financial products by smallholder farmers

Genesis Analytics was contracted by the Kenya Commercial Bank to undertake an impact evaluation of MobiGrow, a product that targets agricultural value chain actors to offer mobile-based financial inclusion and information to smallholder farmers and pastoralists in Kenya and Rwanda.

Evaluating project for affordable, inclusive financial products

Genesis was appointed by AccessHolding to conduct a mid-term evaluation of the Access2Acces programme to understand its performance and outcomes till the mid-point of the programme, in order to document key learnings arising from implementation, and to identify areas for improvement.

Strategy for mobile-wallet partnership opportunities in Africa

Genesis Analytics was commissioned by a global card association to conduct a mobile-wallet partnership opportunity assessment across five countries, Ghana, Senegal, Madagascar, Cote d’Ivoire and Mauritius. This entailed assessing and mapping the payment landscape in each country and identifying key payment opportunities in the mobile money, card and digital payments space.

Cloud-based solutions could reduce banking costs in Africa

Genesis Analytics and Orange Business Services (OBS), with the support of the Bill and Melinda Gates Foundation, published a research report on Cloud Banking in Africa: The Regulatory Opportunity, which explores the potential for cloud computing to reduce the cost of technology for banks.

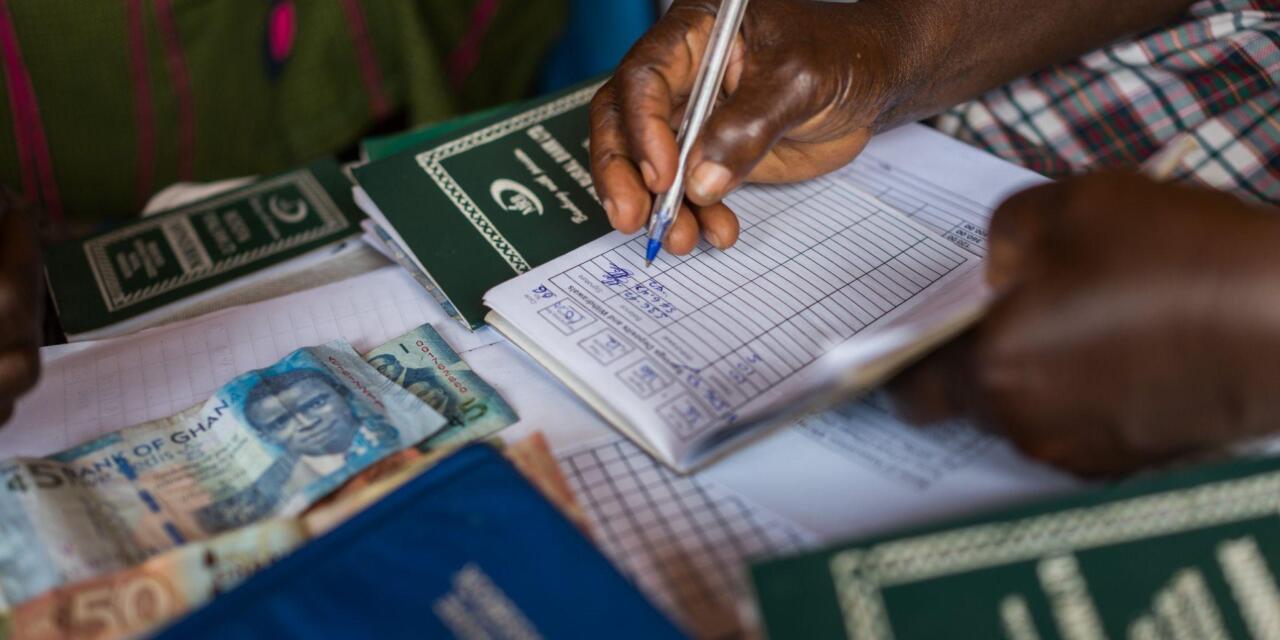

Mid-term review of largest UN project in digital finance

Genesis was contracted to conduct a mid-term evaluation of Mobile Money for the Poor (MM4P), the largest of the UNCDF’s programmes in digital finance. The evaluation was based on a theory-based approach and used the OECD DAC criteria as its guiding framework.

A winning strategy for deepening financial markets in Uganda

Genesis Analytics have been working with Financial Sector Deepening (FSD) Trusts on a number of projects. FDS commissioned Genesis first to re-invigorate their approach to facilitating financial-sector deepening in Uganda. We then helped FSDU develop a refreshed strategy for the next three years and then assisted them with a critical part of strategy execution related to fundraising.

Diagnosing the MSME development challenge in four countries

Genesis partnered with the prominent private foundation to diagnose the MSME landscape in four countries of interest. The foundation was new to the area of MSME development and required guidance on how best to diagnose the key growth constraints and programming opportunities for MSME development.

Evaluation of Microcred’s plan to bank a million new customers

Genesis Analytics was contracted to conduct an evaluation of the Mass Market Financial Inclusion (MMFI) project, which aims to provide access to key financial services for the unbanked populations of Senegal, Côte d’Ivoire and Madagascar.

Mid-term review of project to support agri-finance innovation

Genesis was contracted to conduct a mid-term evaluation of the Financial Inclusion for Smallholder Farmers in Africa Project, which is aimed at improving food security and incomes of over 700 000 smallholder farmers in Ghana, Kenya and Tanzania.

Impact evaluation of POWER Africa in Rwanda

Genesis was contracted to do an impact evaluation of CARE Canada’s Promoting Opportunities for Women’s Economic Empowerment in Rural Africa (POWER Africa) initiative in Rwanda. Funded by the MasterCard Foundation, POWER aims to improve financial inclusion in Burundi, Côte d’Ivoire, Ethiopia and Rwanda by linking village loan and savings associations with formal financial institutions.

Risk assessment of new distribution channels

Genesis Analytics was commissioned to conduct a risk assessment of the alternative distribution channel (ADC) strategy of four different financial institutions in Kenya, Ghana, the Democratic Republic of Congo (DRC) and Tanzania. In each instance, the project team developed a risk assessment framework and identified the kind of project risks that the institutions had experienced.

Access-to-finance model for Mozambique

A consortium of Genesis and the International Capital Corporation (Mozambique) was awarded the contract to design an access-to-finance programme in Mozambique. This was to be based on the model of the Financial Sector Deepening Trusts that DFID has established in various African countries including Kenya, Tanzania and Uganda

Strategy for large microfinance investor

Genesis was commissioned to undertake a review of the Africa strategy for a large non-profit organisation focused on improving access to finance across the world. Its activities include direct investments in microfinance institutions and related technology providers as well as investments in capacity-building services for the industry and clients at the bottom of the pyramid.

Strategy for financial inclusion unit of Ghanaian bank

Our assignment was to assist a leading Ghanaian bank's Financial Inclusion Unit (FIU) to deliver on its overarching goal of having five million active accounts by 2018, and to identify ‘capability’ gaps that could potentially be supported by FSD Africa. The analysis involved a market opportunity analysis and internal capability assessment.

Value assessment of Access to Finance Rwanda

Genesis was contracted to take stock of Access to Finance Rwanda's progress in achieving its goal and conduct a value for money (vfM) assessment of AFR’s investments in 2015. Following this work, Genesis was contracted to review their MRM system. After the review, AFR retained Genesis in 2016 to streamline its MRM component and facilitate the effective communication of its results internally and externally.

Review of the Ugandan Microfinance Sector

Genesis was commissioned by DFID and the Ugandan financial services inclusion programme to conduct a review of the progress made within the microfinance industry in Uganda, consider the emerging trends in the sector as well as to provide a look into the future and recommend new strategies for increasing the level of financial inclusion.

Access to finance for 12 000 small-scale farmers

Genesis was commissioned by the Zimbabwe Agricultural Development Trust (ZADT) to develop and pilot financial products suitable for direct access by smallholder farmers. Small-scale farming is the backbone of the rural livelihoods in Zimbabwe but the farmers often struggle to access finance for agricultural production, locking them into low input- low output production models