Financial Services Strategy

Financial Services Strategy

Overview

Our Financial Services team has completed more than 1000 projects across sub-Saharan Africa and the Middle East since 2001. We work with leading financial institutions to address their challenges, unlock value for their stakeholders and shape the future of the industry.

Our team understands the evolving technology and market structures, economics and regulatory trends across all segments of the financial services sector. Our distinct approach is characterised by deep specialisation and rigorous analysis based on a strong economics foundation.

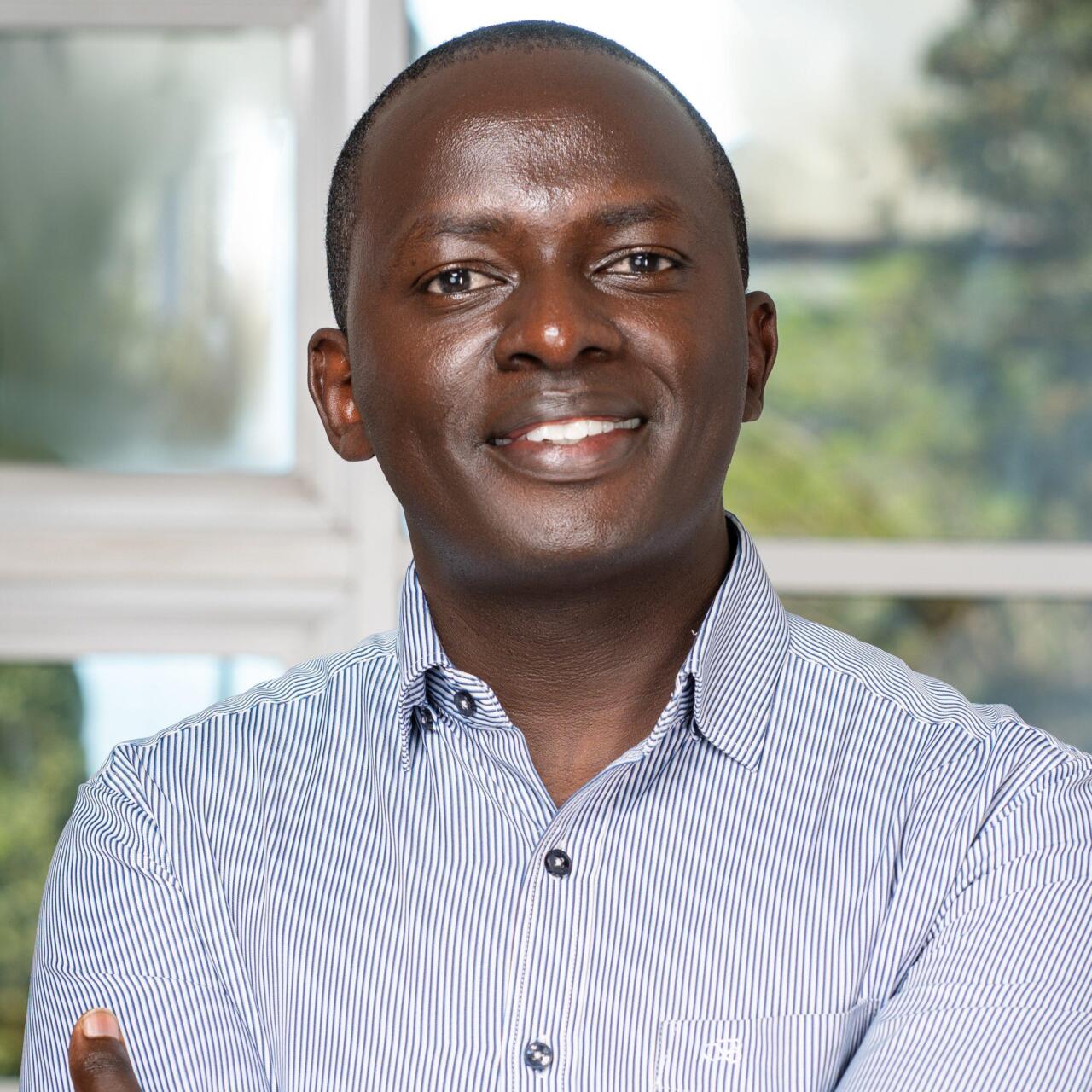

Leading The Team

Additional info

Areas of Expertise

Financial sector strategy

Genesis offers a wealth of experience in providing strategy support to financial services players, with two decades of experience and over 600 successfully completed projects in Africa and the Middle East.

Our clients are diverse. We assist governments and government agencies in developing long-term strategies aimed at economic development and advise donors in developing their initiatives to better reach their targeted segments.

Digital financial services

At Genesis we provide digital strategy support and advice to our clients looking to embark on a transformation journey, enter new markets with a digital proposition, or optimise their existing strategy through better use of digital analytics.

We have a broad understanding of fintech innovation and keep abreast of developments across the financial service core competencies. These include payments, lending, deposit taking, investments, and wealth management and capital markets.

We have advised a number of financial institutions on their digital transformation journeys and have contributed to how policymakers can support and enable innovation that promotes improved access to finance while protecting consumers and ensuring the stability of the financial services sector.

Market analysis and positioning

Genesis has built diverse expertise in conducting market-sizing and positioning exercises across Africa and the Middle East, working with a variety of financial services, including credit providers, large financial institutions and donor organisations.

We have helped multinational credit providers in Africa to understand the size of the markets for their products by breaking down the addressable market into target segments. In addition, we have assisted large financial institutions, including pan-African commercial banks, in sizing the retail, business banking, and corporate and investment banking revenue pools in their markets.

Applied behavioural economics

Behavioural economics is a powerful field that combines economics and psychology to influence behaviour and improve decision-making for the better through low-cost, high-impact, easy-to-implement interventions. Genesis Analytics created the first team of consultants in Africa in 2014 to use a scientific understanding of human behaviour to solve practical problems in the world of business.

Financial risk management

Risk management is a topic that has taken on greater importance in light of the increased complexity surrounding financial markets and the banking sector. As a result, establishing appropriate risk-management processes to identify, understand and manage risk are a priority for financial institutions.

Genesis offers highly experienced risk-management professionals, who have decades of experience of working in and consulting to the financial sector. We offer our risk-management advisory services to financial institutions, including commercial banks, central banks, development finance institutions, stock exchanges and non-bank financial institutions, covering an array of risk categories.

Financial market policy

At Genesis, we have built considerable expertise in the financial services policy space, spanning a variety of facets, including economic developments, fintech, banking and capital markets.

Our work with donors and public sector players has involved supporting policy interventions to further their goals across Africa.

Financial inclusion

Financial inclusion remains an acute challenge across Africa, with many people in the sub-Saharan region lacking access to basic financial products and services, such as credit, savings and insurance products. The effects of financial exclusion fall disproportionately on particularly women, low-income groups, rural inhabitants and small businesses. These groups have traditionally been underserved by traditional financial services. Genesis has built deep expertise in driving financial inclusion across these groups in Africa.

Payments

Genesis has deep experience in the payments space, with expertise spanning Africa and the Middle East. Given the importance of payments in allowing individuals, businesses and governments to transact quickly and affordably, our work has implications for both public and private sector strategies, payment regulation and oversight, as well as financial inclusion - all areas in which we consult widely.

Strategic due diligence

Genesis has built substantial experience in conducting due diligence research to underpin and advise in a number of transactions across the financial services space, across geographies spanning Africa and the Middle East.

The acquisitions that we have consulted on vary considerably. We have advised donor organisations and global private equity firms as they have sought to acquire new and innovative players in the payments space, credit-rating agencies and even on social projects, such as those targeting housing and urban development. In addition, we have aided large commercial banks evaluate the appropriateness of acquiring operations such as additional retail banking offerings, while also advising governments that are restructuring and privatising state-owned banks by assessing their financial and managerial capabilities.

Projects

Inaugural strategy to boost Kenyan home ownership

the National Treasury of Kenya commissioned Genesis to develop the inaugural 2020-2024 strategic plan for the Kenya Mortgage Refinance Company, which was established as a non-deposit-taking financial institution to provide long-term funds to primary mortgage lenders.

Related Focus Areas

Agriculture and agribusiness

Africa’s agricultural sector is critical to sustainable economic development. It supports economic opportunities in rural communities, the alleviation of poverty and plays an essential role in food security. Genesis works across the public-private interface for governments, donors, philanthropic and private sector clients.

Unlocking the sector’s potential requires a combination of political will, enabling regulatory frameworks, improved access to finance, skills investment and climate change adaptation. An understanding of these interlocking factors underpins our approach to programme design and implementation.

Behavioural solutions

Genesis recognises that certain problems in commerce and development demand an expert understanding of human behaviour. Moreover, the quality of traditional solutions can often be dramatically improved by incorporating behavioural expertise. Behavioural Solutions at Genesis combines expertise in economics, psychology, anthropology and sociology to unlock value.

Competition economics

As the leading provider of competition economics services in Africa, Genesis Analytics has an unmatched breadth and depth of skills and experience. Blue-chip companies across Africa routinely rely on us for expert advice and support when they interact with competition authorities. We also work extensively with regulators and competition authorities, giving us a position of trust based on a strong reputation for providing robust and independent expert economic views.

Economic opportunity

Expanding access to economic opportunity is essential for improving lives and livelihoods, generating jobs and creating wealth. The private sector plays a leading role in delivering economic growth and is increasingly expected to do so in a way that is inclusive and sustainable.

There are a number of ways in which businesses, foundations, governments and development organisations work to support private sector development. These include developing inclusive market systems; supporting the creation of quality jobs; developing value chains and access to markets for businesses; development of the financial sector and supporting access to finance; MSME development; capital markets development; and overall business enabling environment.

Monitoring, evaluation and learning

We work to maximise the social and economic impact of development efforts. As a trusted provider of monitoring, evaluation and learning (MEL) services we combine our deeply rooted understanding of the African context with our extensive experience in qualitative and quantitative monitoring and evaluation (M&E) methods to assess progress, measure value creation, and facilitate internal and external learning.