Country platforms as the governance engine for climate finance

2 December 2025

The momentum for systemic change in adaptation finance is accelerating. At COP30, two major breakthroughs signalled a shift toward scale. First, parties agreed to triple global adaptation finance by 2035, targeting US$120 billion annually as a response to mounting demands from countries already experiencing severe climate impacts on lives, economies, and strategic sectors. In Africa, for example, climate stress is undermining core export crops such as cocoa and coffee, eroding rural livelihoods and weakening foreign-exchange stability.

Second, the Green Climate Fund announced fourteen new Country Platforms - including pilots in Lesotho, Nigeria, Rwanda, South Africa, and Togo - designed to move from fragmented project-by-project support toward coherent, climate-ready financial systems. These platforms bring together ministries, regulators, development partners, and the private sector under a unified investment plan, with the aim of turning climate ambition into bankable pipelines.

Yet coordination alone will not unlock capital at the required scale. To translate these platforms into real investment flows, they must be anchored in a financial architecture capable of executing adaptation at system level - with aligned policies, incentives, regulatory frameworks, and market infrastructure that allow capital to move efficiently into resilience-building sectors.

Genesis is a technical partner to GCF’s Readiness Programme, and our previous work throughout the African continent has sparked some ideas to tackle this challenge.

The broken model of climate finance

Currently, the market fails to scale because this architecture ignores the structural reality of the African economy. Capital markets privilege large, hard-currency investments, whereas African adaptation needs are predominantly small-scale, local-currency, and rural. A fundamental size mismatch exists: Multilateral Development Banks (MDBs) typically deploy ticket sizes of US$10–30 million, yet investable opportunities in nature-based sectors are significantly smaller.

This discrepancy creates prohibitive transaction costs that deter national financial institutions. Furthermore, a currency mismatch stifles borrowing; as most African MSMEs earn local revenues, hard-currency debt exposes them to unsustainable foreign exchange risk. Without a clear taxonomy or regulatory incentives, banks view the sector as high-risk and low-reward. Consequently, 47% of DFI operations concentrate in just three markets - South Africa, Nigeria, and Kenya.

This exclusion fuels a structural paradox: adaptation flows have doubled, yet the resilience gap widens. Between 2017 and 2023, adaptation finance rose from US$6.3 billion to US$14.8 billion.

While significant, this remains a fraction of the US$70 billion required annually by African NDCs. More critically, the composition of this capital is flawed. International public institutions provide nearly 90% of tracked finance, creating a staggering 98:2 imbalance between international and domestic sources. Loans dominate the landscape (53%), exacerbating debt burdens in vulnerable economies. With commercial capital contributing only 6% - much of it philanthropic - the current model relies too heavily on constrained fiscal budgets and sovereign debt.

Moving to solutions

Successful pilots prove that private capital moves when the ecosystem is de-risked. We need not speculate on solutions; existing models demonstrate that adaptation is bankable when structured correctly.

- CRDB and Green Climate Fund (GCF): A blended facility in Tanzania combined a US$100 million concessional loan with technical assistance (TA). This allowed CRDB to build internal climate-risk systems and lend to smallholders, proving that concessional capital can unlock domestic banking value chains.

- Acorn and GuarantCo: In Kenya, a partial credit guarantee allowed Acorn to issue a shilling-denominated green bond. This de-risked the instrument, unlocking capital from local pension funds and insurers - a blueprint for solving the FX liquidity trap.

- Equity Group and IFAD (ARCAFIM): This regional facility blends US$90 million in concessional on-lending with TA to reach rural MSMEs. It simultaneously strengthens the bank's borrower readiness and its own climate-risk governance.

UNIDO and CDP (Under Design): Backed by the Italian Climate Fund, this initiative is structuring a €120 million adaptation credit facility for Uganda’s coffee sector. The model utilises risk-sharing instruments to channel affordable finance through local banks and SACCOs, empowering smallholders to adopt climate-smart technologies and strengthen resilience across a critical value chain.

The next steps

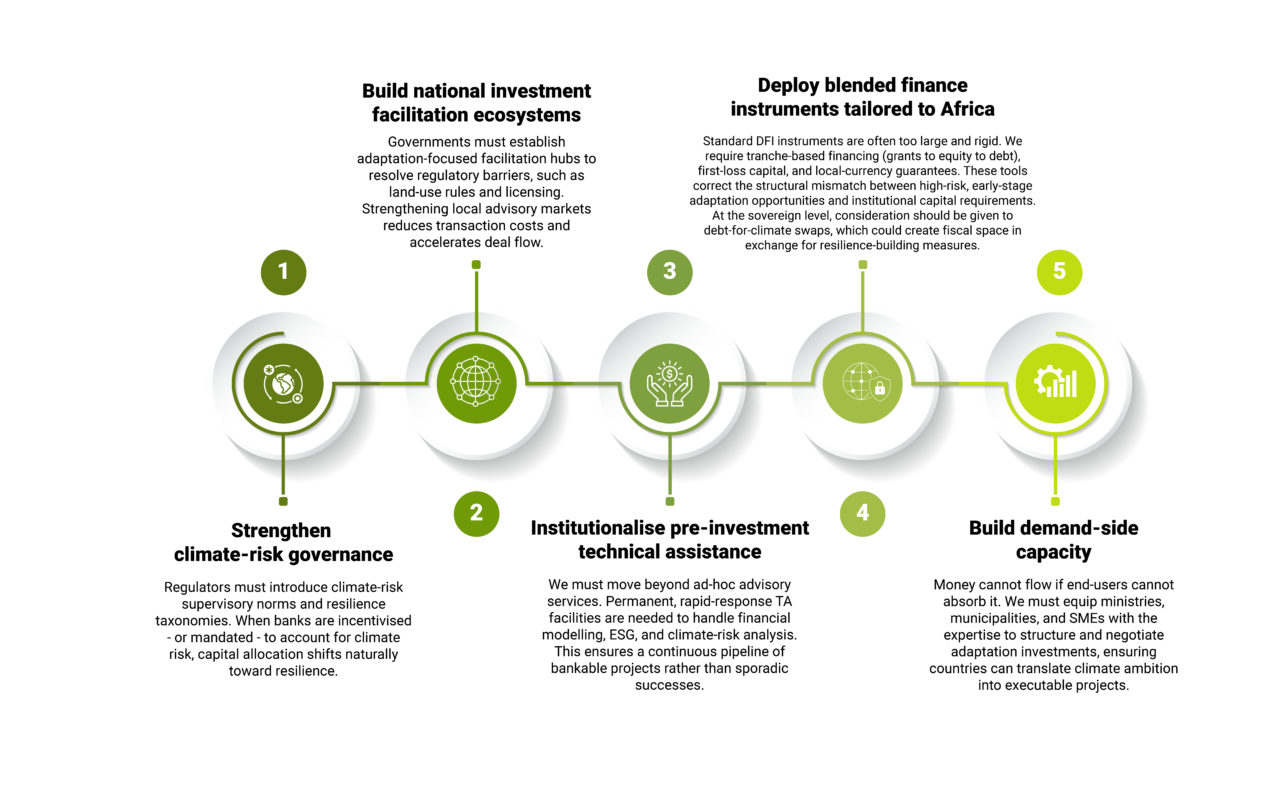

To operationalise country platforms and mainstream adaptation finance, there are a number of things the Country Platforms need to get right.

Genesis suggests an approach that aligns the platforms around a five-point systemic approach: Current successes show pathways that can converge in such an approach. To bridge the gap, governments, DFIs, and the private sector must align around a five-point systemic approach

The question is no longer whether adaptation finance works in Africa; the evidence shows it does. The challenge is that our current financial systems are not designed to scale it. Relying on fragmented pilots will not shift the architecture of capital allocation.

By building a coherent ecosystem we can unlock layers of capital: Impact investment, donors, domestic and local financial institutions. Turning NDC 3.0s into investable plans requires a bottom-up transformation of African financial systems to effectively allocate capital to activities that harness the resilience dividend.

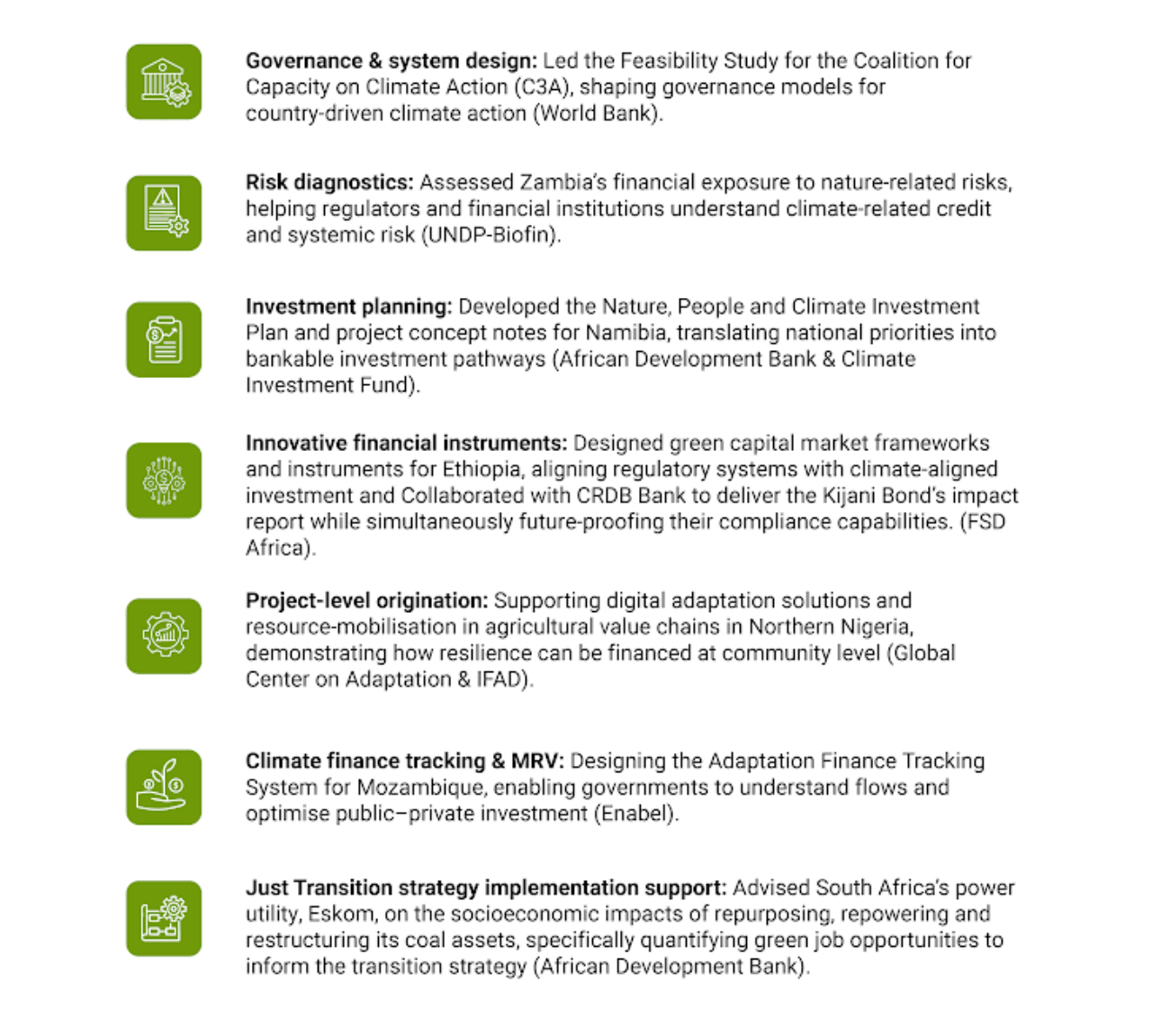

Our technical expertise

Delivering the five-point systemic approach outlined above requires partners that combine policy insight, financial architecture expertise, and on-the-ground implementation capacity. Genesis brings a unique combination of these capabilities, demonstrated through work across 51 African countries. Our track record spans the full climate finance value chain:

Genesis is part of the Green Climate Fund’s Long-Term Agreement to deliver readiness technical assistance, positioning us inside one of the most important funding channels for African adaptation.

These credentials position Genesis as a catalytic partner to help operationalise Country Platforms, strengthen national climate finance architectures, and accelerate adaptation investment pipelines across Africa.