What we have learned about pricing payments during Covid-19

13 November 2020

COVID-19

Much has been written about the accelerated adoption of digital payments during the Covid-19 crisis. Sometimes the data has been muddy. A rising share of digital payments in a shrinking market may still result in a fall in volumes.

"One of the biggest challenges any payment service provider faces is trying to determine consumers' price sensitivity to fees," Richard Ketley, managing partner of Financial Services Strategy at Genesis Analytics.

Actions by Central Banks that have slashed the price of digital payments in an attempt to encourage digital adoption thus provide a perfect real-world experiment on the impact of price on how active users adjust the volume and value of digital payments they make.

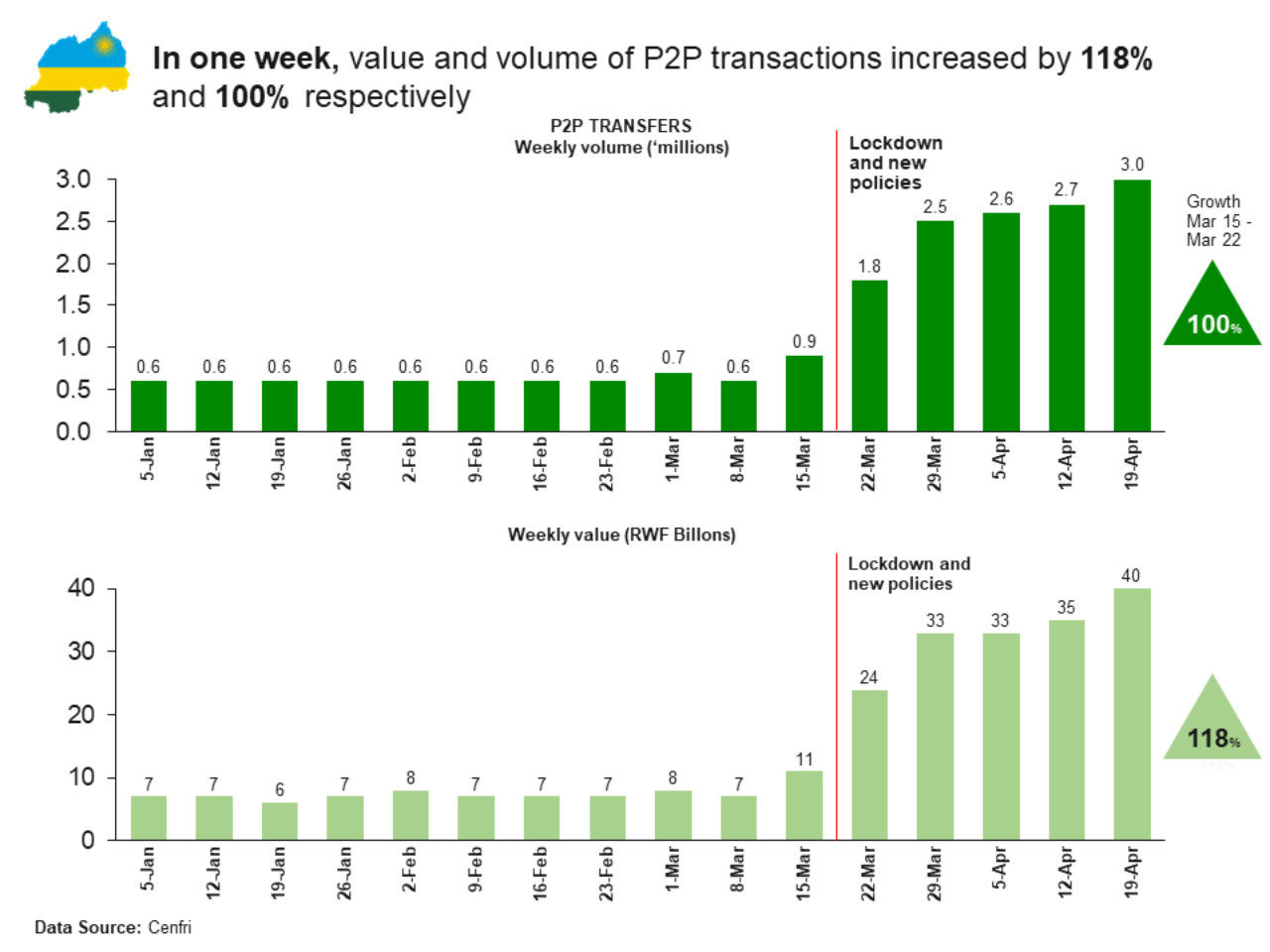

The graph below shows that a decision in Rwanda to waive charges on person-to-person (P2P) payments saw a 100% increase in volume and 118% increase in the value of P2P transfers in one week and a threefold increase within a month.

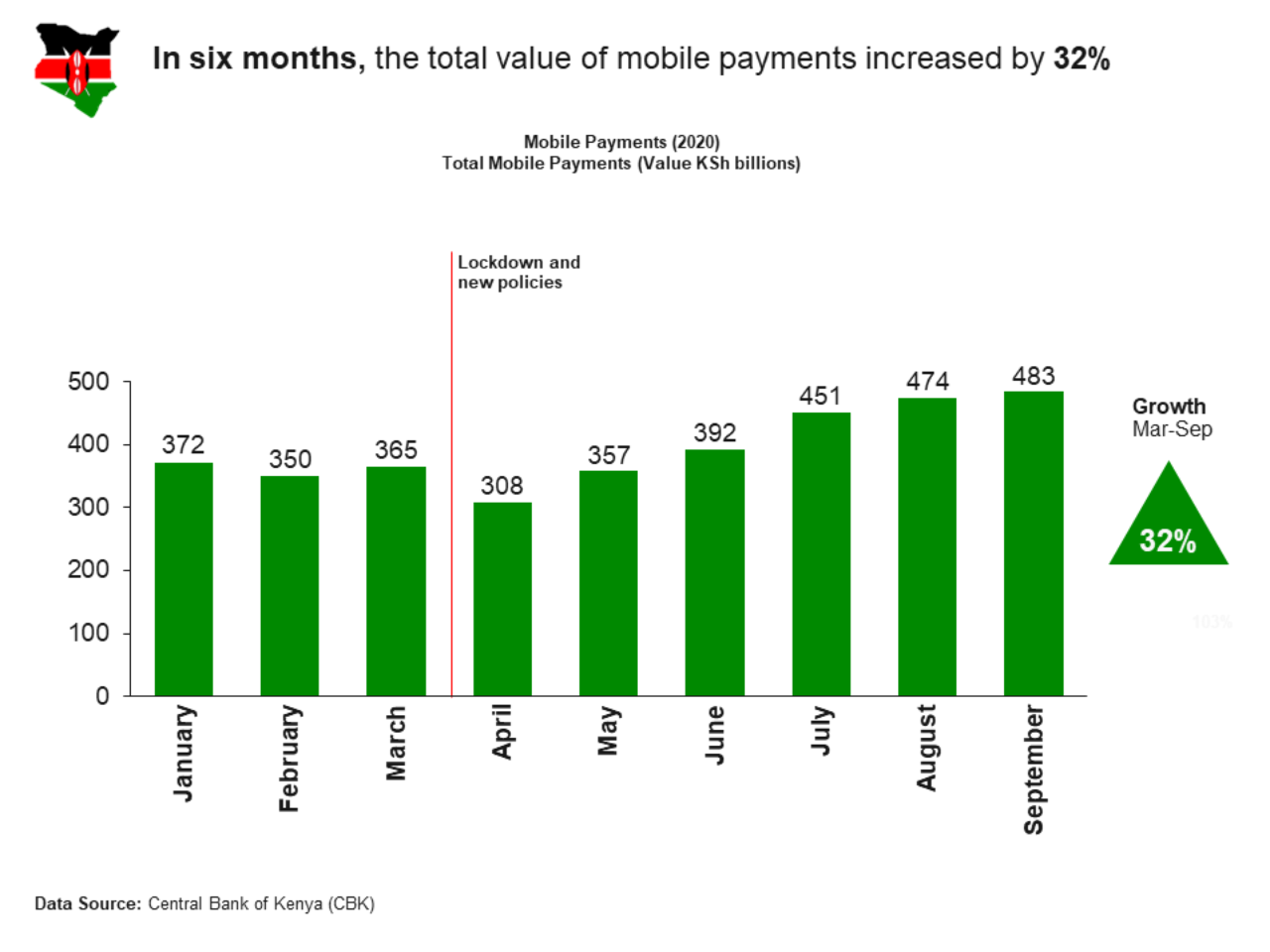

A decision by the Central Bank of Kenya to ask Safaricom (M-PESA) to waive fees on transactions of less than Ksh1000 ($10) had a similar effect - the value of transactions increased by 32% in 6 months, however overall M-PESA revenues fell by 14.5% year-on-year.

Unless the providers of these services can find other sources of revenue neither of these strategies are sustainable, but the consumer response suggests that there are lower price points for the service in both markets that would leave both consumers and providers better off.

First published on LinkedIn on 13 November 2020